Fachwissen für den Mittelstand

Der VBU Blog

Lernen Sie unsere Experten und Autoren kennen. Fachwissen für den Mittelstand.Trump 2.0 & US-China Relations: Preparing for Turbulent Times

Following Donald Trump’s victory in the 2024 US presidential election, Chinese officials braced for another turbulent chapter in China-US relations. At present, it is crucial to approach scenarios regarding the actions of the new Trump administration with caution.

On one side, the administration's controversial personnel appointments to key cabinet positions could trigger significant domestic and intra-party turbulence. Conversely, President Trump's unpredictable nature complicates assessments of his likely approach. Will he act as a pragmatic, transactional business leader open to negotiation? Or has his first-term experience with Beijing convinced him that China must be curtailed, leading him to heed the advice of security hawks within his circle disproportionately?

Furthermore, the emergence of rival factions adds another layer of complexity. The divide between traditional neoconservative Republican premacists and those advocating for a more restrained foreign policy underscores the uncertainty surrounding the administration's trajectory.

Geopolitics

A second Trump term is likely to perpetuate confrontational rhetoric and unilateral actions against China, potentially reshaping global geopolitics through protectionist, isolationist, and nationalist policies.

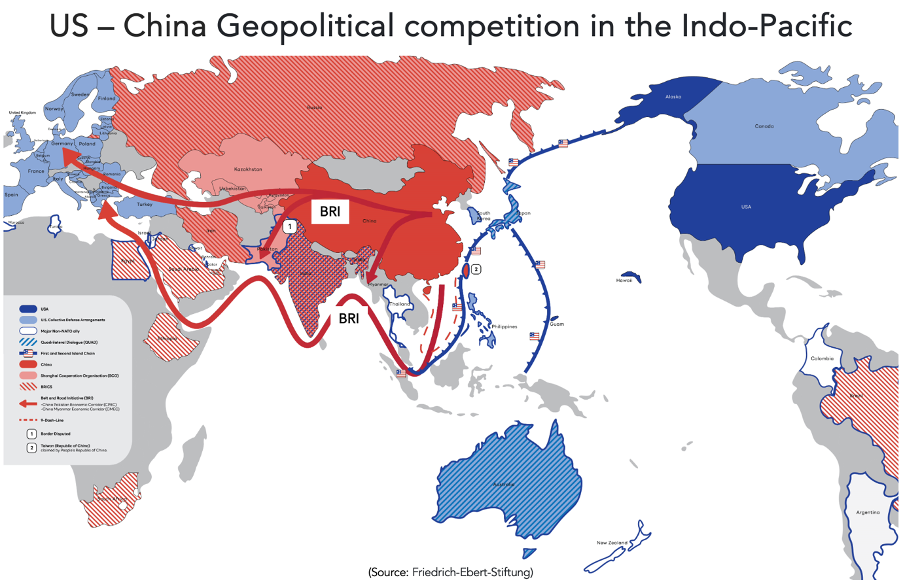

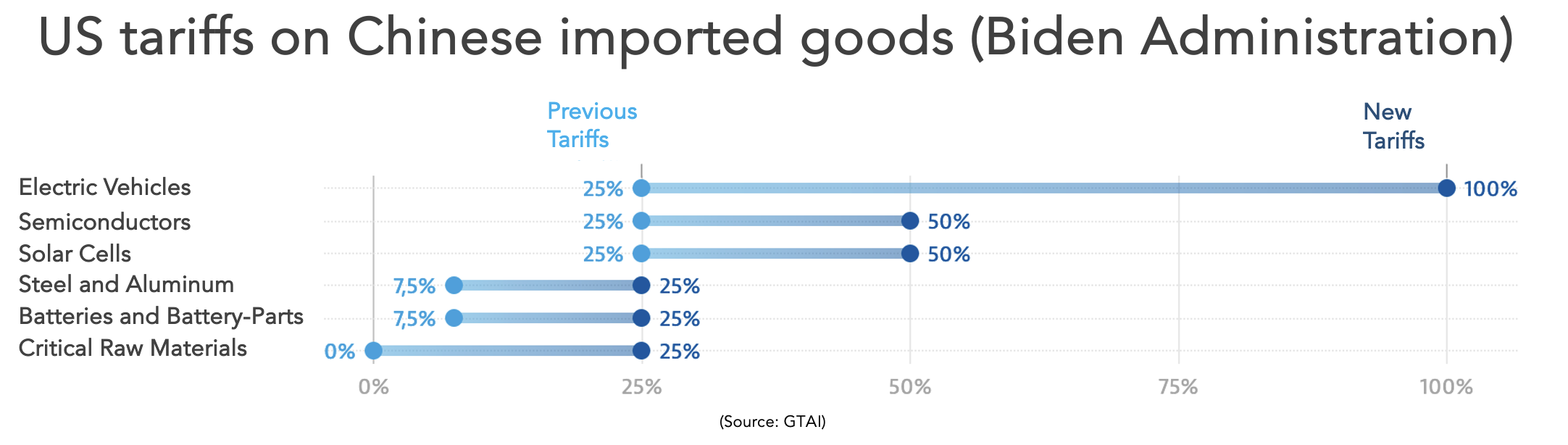

This approach could see a redirection of US resources toward domestic priorities, further exacerbating tensions with Beijing. The appointment of prominent China hawks, such as Marco Rubio (Secretary of State) and Mike Walz (National Security Adviser), to key cabinet positions signals a likely escalation of tough policies targeting China across multiple fronts. These include challenges to Beijing’s geopolitical influence in the Indo-Pacific and South China Sea, the imposition of new tariffs/ trade barriers, and stricter restrictions on access to Western technology. Such actions would contribute to an increasingly adversarial relationship between the two nations.

However, an alternative scenario involves Trump adopting a more isolationist stance, driven by internal Republican Party pressure to curtail US involvement in overseas engagements. While Trump has maintained ambiguity regarding Taiwan, some of his China-focused advisors may advocate for a more explicit pro-independence policy. This would represent a significant escalation of tensions, as it crosses a well-established red line for Beijing, increasing the risk of confrontation in the Taiwan Strait. Additionally, military-to-military dialogues with China, which were disrupted during Trump’s first term but later reinstated under Biden, could again face suspension, heightening the risk of miscalculation or conflict.

From Beijing’s perspective, a second Trump administration’s isolationist tendencies could present challenges and opportunities. The return of "America First" diplomacy may allow China to position itself as a responsible global power, championing free trade and multilateralism, contrasting sharply with rising US protectionism and unilateralism. This shift could facilitate Beijing's efforts to expand its influence, particularly in the Global South, and strengthen trade and security partnerships within regional blocs. By exploiting a disengaged and commercially aggressive US, China could bolster its role in shaping an increasingly multipolar world order aligned with its interests.

- Trump’s ‘America First’ foreign policy will accelerate China’s push for global leadership (Chatham House 11/24)

- What Does America Want From China? (Foreign Affairs July/August 2024)

Trade and Tariffs - A Renewed Escalation?

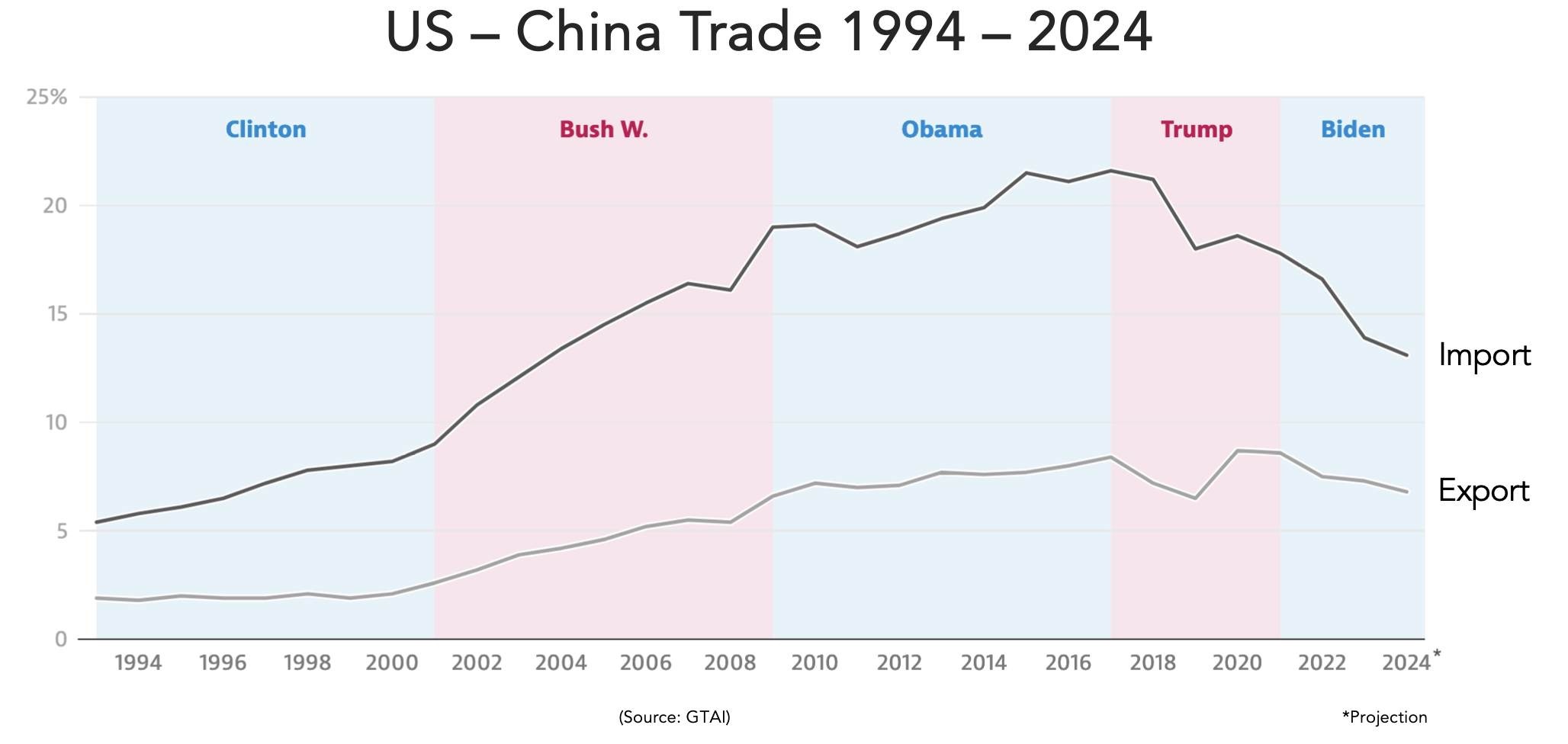

Trade and tariff policies have become central to the US strategy toward China, garnering bipartisan support across the political spectrum. Both Republicans and Democrats emphasize the importance of reducing the trade deficit with China and curbing reliance on Chinese imports—a process commonly referred to as "de-coupling." This consensus has driven the adoption of significant trade barriers under both the Trump and Biden administrations.

With President-elect Trump preparing for a second term, his administration has signaled a more aggressive approach to US-China trade relations. Trump has proposed imposing sweeping tariffs of 60% or more on all Chinese imports—a policy that, if enacted, could severely impact bilateral trade and create substantial disruptions in global supply chains. While it remains uncertain whether tariffs of this magnitude will materialize, it is highly likely that new trade barriers will be introduced, escalating tensions between the two countries.

Timing is another critical factor. During Trump’s first term, significant trade actions were not undertaken until the second year. However, given the current geopolitical climate, a faster implementation of tariff measures may occur.

Beyond tariffs, Trump is also expected to intensify restrictions on Chinese technology exports and may even consider revoking China's permanent normal trade relations (PNTR) status, formerly known as most-favored-nation (MFN) status.

Notably, China's economic position has evolved since the initial wave of tariffs in 2018, which eventually covered approximately $400 billion worth of Chinese goods. Chinese manufacturers have diversified their markets, increasingly targeting customers in Southeast Asia and Latin America. As a result, China’s share of US imports has declined from 20% to 13% over the past six years. However, part of this shift is attributable to Chinese goods being routed through intermediary countries like Mexico and Vietnam to bypass US tariffs. While the specifics of the forthcoming US-China trade strategy remain uncertain, the potential for a renewed trade war is high, with significant implications for global economic stability.

In a worst-case scenario, the disintegration of the World Trade Organization (WTO) or the emergence of competing geopolitical blocs could result in significant global economic disruptions. Projections suggest that such a scenario could reduce EU GDP by up to 0.5%, with Germany experiencing a more pronounced contraction of 3.2%. China, however, would incur the most substantial economic losses under these conditions (IFW).

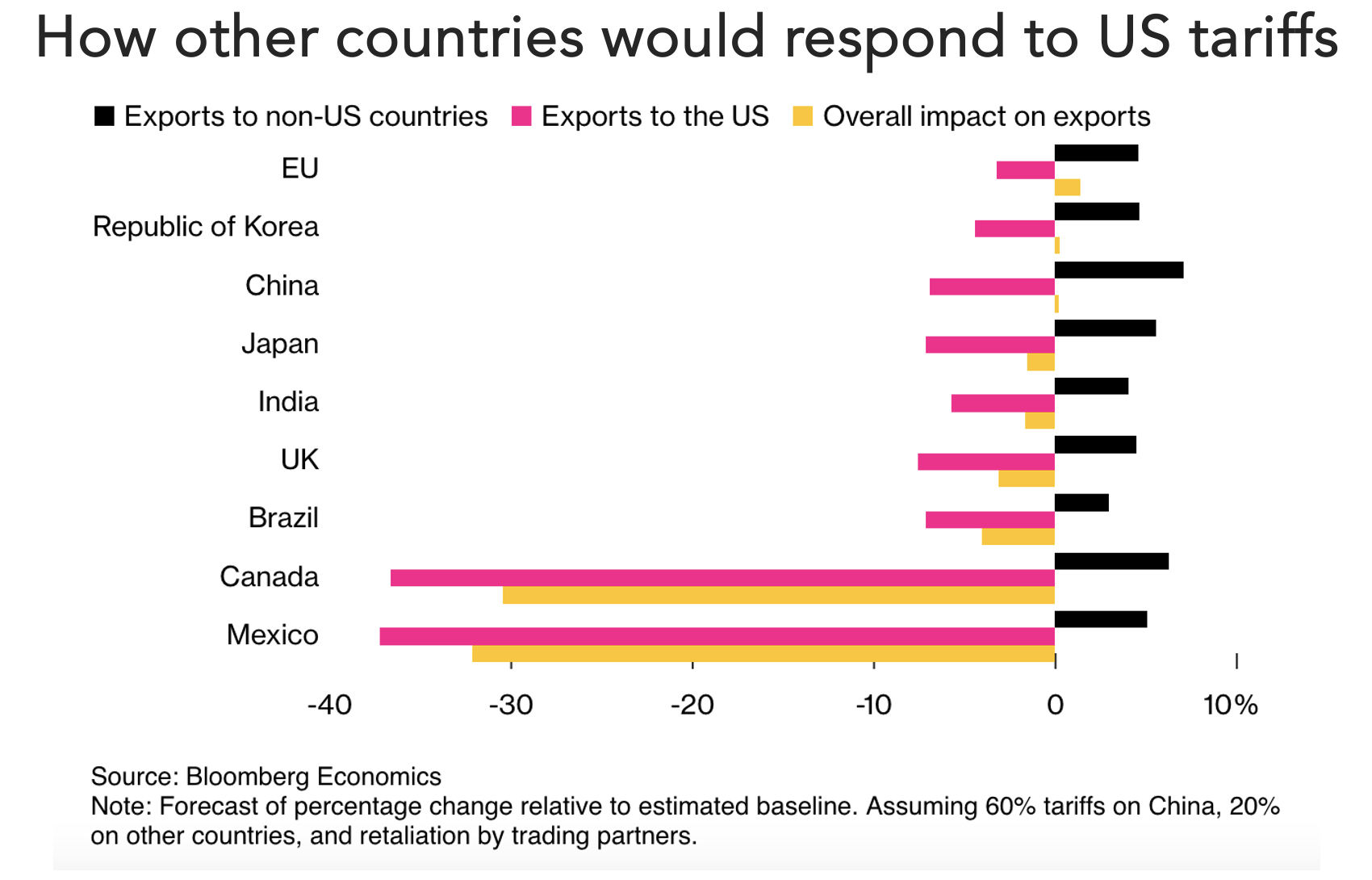

Conversely, analysis from Bloomberg Economics on the potential impact of former US President Donald Trump’s proposed tariffs indicates that other countries might mitigate their trade losses with the US by intensifying trade relations with alternative partners. This finding underscores the possibility that globalization could persist robustly, albeit with the US no longer at its core.

- US Trade Policy After 2024: What Is at Stake for Europe (IFW 10/2024)

- What’s Left of Globalization Without the US? (Bloomberg 11/2024)

Implications of a Renewed US-China Trade Conflict on the Chinese Economy

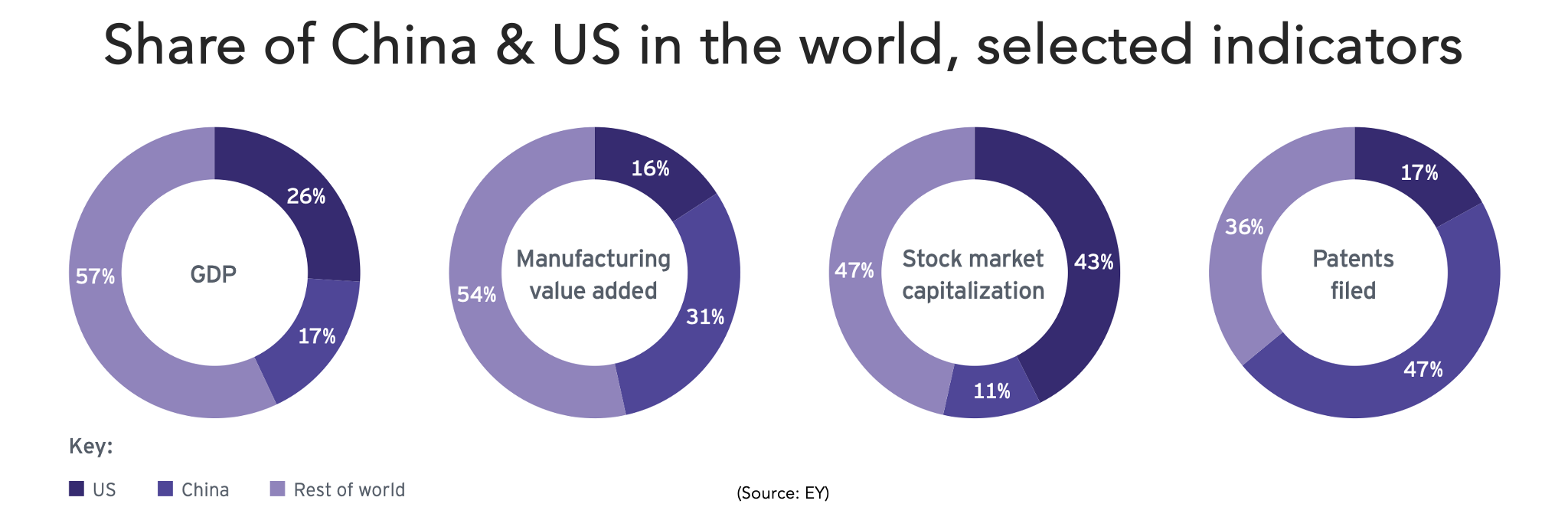

The prospect of a renewed trade conflict presents a significant challenge to China’s economic stability, particularly in the short term. China's vulnerability to trade disruptions has grown, as the nation now accounts for 17% of global exports, up from 12% during the early years of the Trump administration. A new wave of tariffs could lead to an 8% decline in Chinese exports within a year, reducing annual GDP growth by approximately 2 percentage points.

In recent years, China has largely refrained from directly retaliating against US tariffs, favoring symbolic measures instead. However, Beijing has developed sophisticated anti-coercion mechanisms that could be deployed if it determines that its policy of strategic patience has failed. This shift suggests a readiness to respond more assertively to perceived economic coercion. Simultaneously, China continues to prioritize economic security, technological self-reliance, and the pursuit of a multipolar global order to mitigate risks stemming from US actions.

Interestingly, certain aspects of protectionist policies, such as Trump’s proposed tariffs of at least 10% on all US imports, could indirectly benefit China. Should major economies perceive the US as an unreliable trade partner, they may deepen trade relations with China in search of more stable and favorable markets. This dynamic is particularly relevant in the green technology sector, where China dominates with control over at least 60% of the global manufacturing capacity for solar cells, wind turbines, batteries, and other components critical to carbon-neutral energy systems.

Domestically, the potential fallout from US tariffs underscores the urgency for China to accelerate its transition toward a consumption-driven economy. Currently, domestic consumption accounts for only about 60% of China’s GDP, significantly lower than the 70-80% seen in many Western economies. This shift is particularly pressing given that Beijing’s recent stimulus measures, while modest, reflect government concern over public dissatisfaction with stagnating living standards. These measures signal a renewed commitment to promoting sustainable economic growth while navigating the dual challenges of external pressures and internal structural adjustments.

- As Trump Threatens a Wider Trade War, the U.S. Confronts a Changed China (NYT 11/2024)

- Trump's threatened China tariffs could actually help Beijing (CBS 11/2024)

Impact on Businesses

The re-election of Donald Trump could have profound implications for global businesses. A second term would likely exacerbate supply chain disruptions, amplify market volatility, and introduce heightened uncertainty into the investment and regulatory landscape. Particularly in the context of US-China relations, which are anticipated to remain tense, Trump's trade policies could reignite a trade war. This scenario would likely compound unpredictability, complicate cross-border operations, and increase the likelihood of tariffs and retaliatory measures.

A renewed trade conflict could place US and European Union companies in precarious positions, potentially caught in the crossfire of escalating diplomatic tensions. While China has refrained from directly targeting US enterprises, instead focusing on attracting foreign investment and enhancing its business climate, the risk of indirect repercussions persists. During Trump’s first term, German companies operating in China experienced significant challenges due to the US-China trade conflict. The 2019 Business Confidence Survey conducted by the German Chamber of Commerce in China revealed that 78% of German firms reported negative impacts, with 31% identifying a substantial disruption to their operations.

To navigate these challenges, businesses must adopt proactive measures:

Supply Chain Diversification: Reducing reliance on single markets or suppliers is essential to mitigate risks associated with potential tariffs, export controls, and logistical disruptions.

Risk Assessment: Comprehensive evaluations of exposure to geopolitical tensions, particularly regarding trade policies and regulatory shifts, are critical for maintaining operational stability.

Policy Monitoring and Adaptation: Companies should establish robust systems for tracking policy changes and geopolitical developments to adapt swiftly to evolving circumstances.

Strategic Flexibility: Maintaining agility in business strategies will enable firms to respond effectively to market volatility, seize emerging opportunities, and mitigate adverse impacts.

The evolving geopolitical landscape underscores the necessity for resilience and adaptability in corporate strategies. By integrating geopolitical risk management into their planning, companies can better position themselves to thrive amidst uncertainty. Leveraging flexibility and foresight will be indispensable for businesses aiming to secure long-term stability and capitalize on emerging market dynamics in a potentially volatile global environment.

- Trump Wins the 2024 US Presidential Election: Implications for China (Dezan Shira 11/2024)

- The road ahead - How the 2024 election will impact your business (PWC 11/2024)

- Trump’s Second Term: The View from Beijing (Trivium China 11/2024)

DIRK MÜLLER (MBA; Dipl.-Pol. International Relations)

VBU Partner in Shanghai/China

Wenn Sie den Blog abonnieren, senden wir Ihnen eine E-Mail, wenn es neue Updates auf der Website gibt, damit Sie sie nicht verpassen.

Kontakt

Verbund beratender Unternehmer e.V.

Adenauerallee 12-14

53113 Bonn

Telefon: +49 228 966985-19

E-Mail: vorstand@vbu-berater.de

Kommentare